XIAOMI

Xiaomi report for 2022, European smartphone prices and the failure of the company’s strategy

Xiaomi has reported for 2022, the annual and quarterly reports deserve a detailed analysis, as they show the implementation of the company’s strategy, it is moving into the premium product segment. Read – raises the prices of all its products, while doing so in a non-uniform way for different markets. In China, due to high competition, they try to keep prices low, but Europe and other markets have to pay almost twice the price of China.

Let’s take a look at a model like Redmi Note 12 Pro 5G, it is already on sale in China, there are various versions from memory – 6/128, 8/128, 8/256, 12/256 GB. The last two versions are not delivered to Europe yet. The price in China for the first two is 215 and 230 euros in terms of, in Europe – 400 and 430 euros. In fact, the difference in price is two times, and this is a conscious strategy of the company, and not some kind of mistake. In Russia, this model is available only on the gray market, where it is sold for 32 thousand rubles, version 8/256 GB. It will be expensive to buy a device from official supplies that will appear later, however, like any new items from Xiaomi, they are expensive.

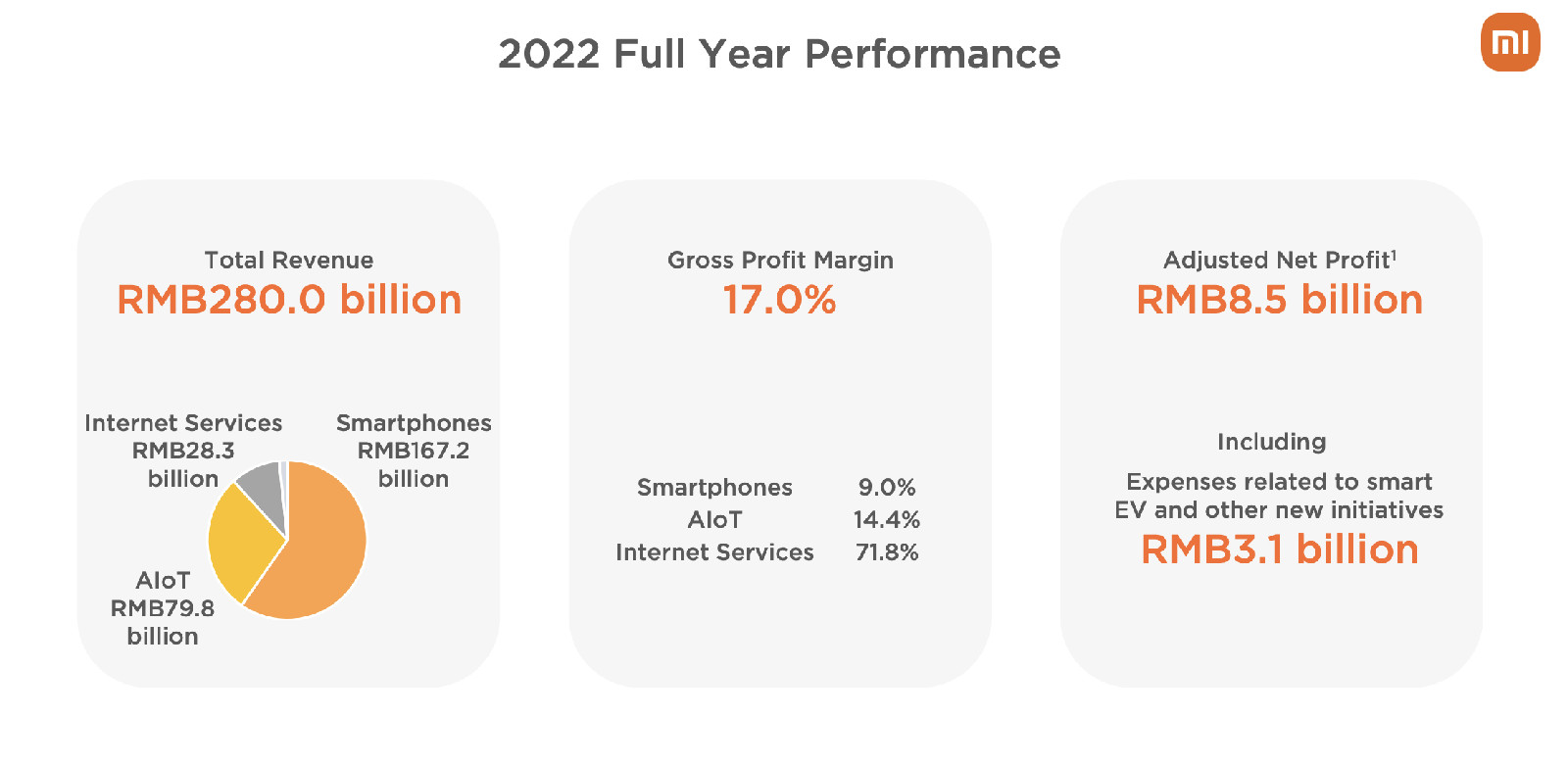

At the end of 2022, Xiaomi has a drop in sales, revenue and profits, the latter has collapsed the most. For the full year, Xiaomi’s revenue was 280.04 billion yuan, down 14.7 percent year-on-year. Profit – 8.52 billion yuan, minus 61.4% year-on-year. Xiaomi’s problems are in misjudging the Chinese market (it fell heavily in 2022). The company’s management said at the call that they did not expect the situation to improve in the first half of 2023, but then it could happen. A miscalculation with the Indian market, where there is a consistent rejection of Chinese smartphones, as well as a choice of models in high price segments, while Xiaomi flooded the market with cheap models. As a result, Samsung lost the competition in the middle segment. The company faces a lot of problems.

Let’s dig into the numbers of the report, as they contain a lot of interesting things that are not officially told to us. After all, the question is how to hide the ends, comb the numbers.

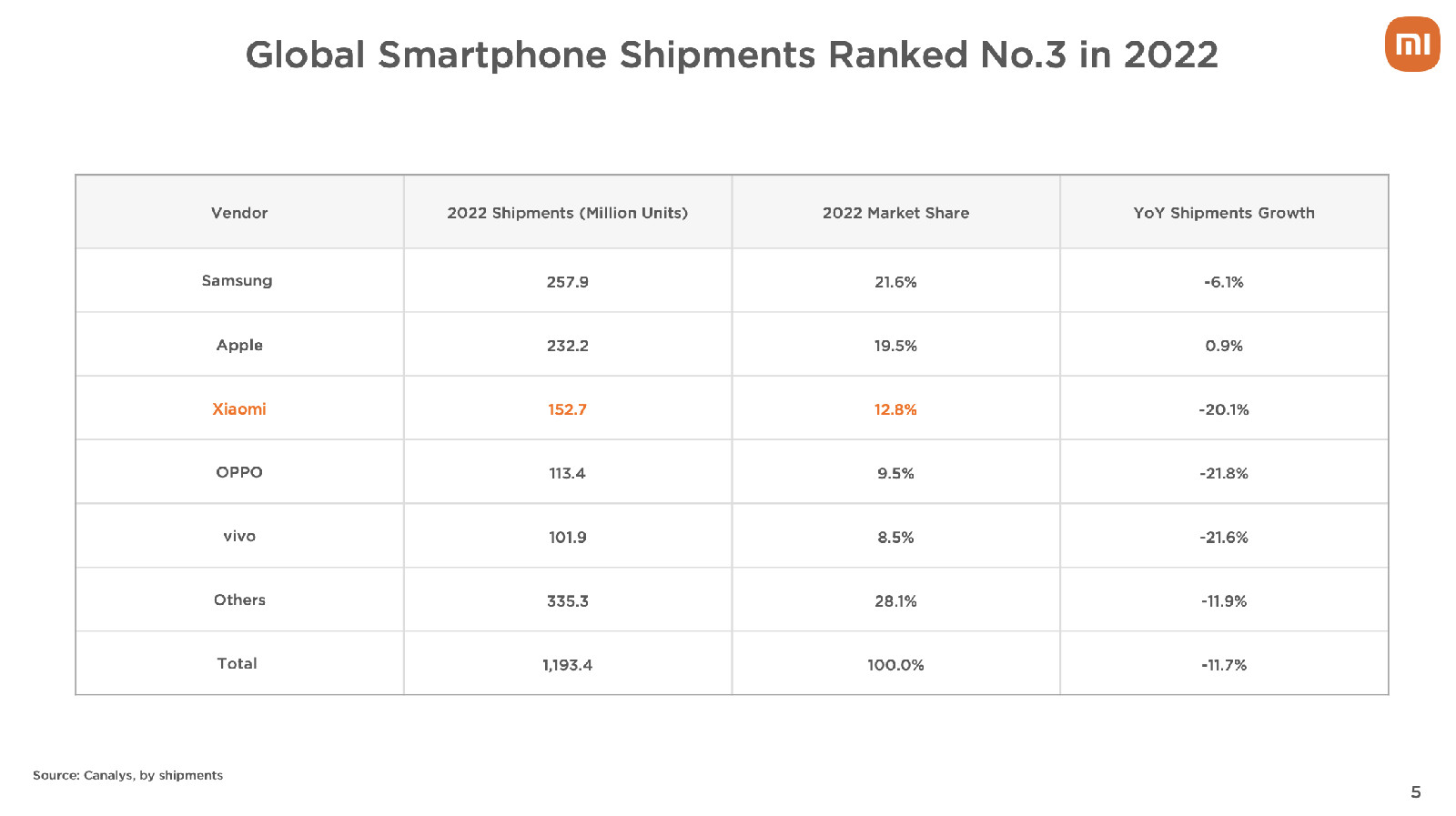

The sales figures speak for themselves, the report cites Canalys data for worldwide deliveries (shipments to the channel).

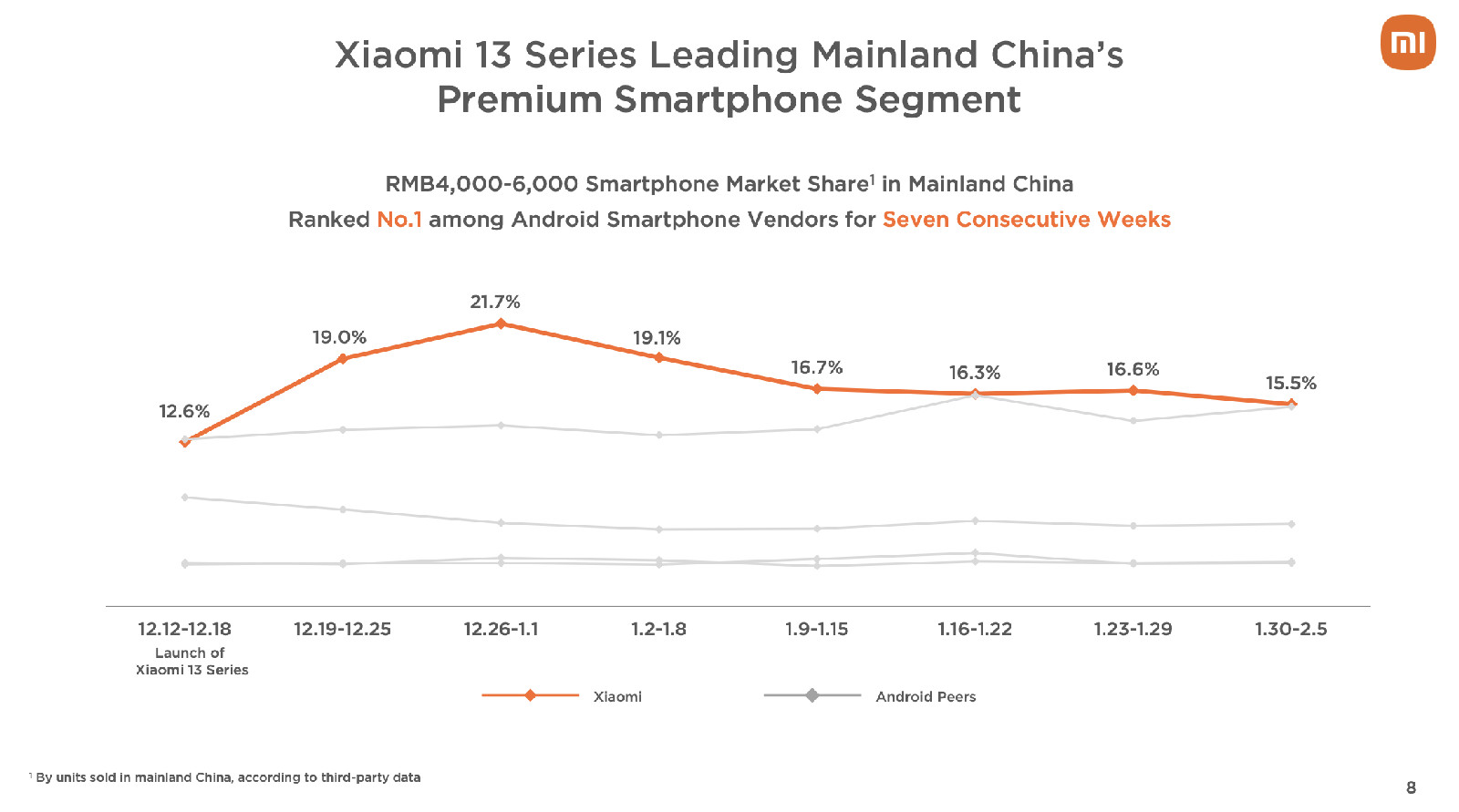

Xiaomi’s strategy is to sell premium smartphones, compete with Apple and Samsung, primarily in China (where Apple has a strong position, but almost no Samsung). And here reports come into play that take into account individual periods when top smartphones are sold at a discount, for example, 7 weeks for the 13th series. This is a combing of reality, and a very naive one at that. In Europe, there are no such discounts, and models come out at much higher prices. What is it for? To fight off low prices in China. Xiaomi does not expect to be able to win competition in foreign markets, where there is Samsung, which in this segment is killing the sales of the Chinese company. Therefore, there is such an imbalance in the prices of devices.

A very interesting slide about the fact that Xiaomi is trying to improve inventory and is actively reducing them.

The answer to how the company does it is given right there in the presentation. The number of Xiaomi products on store shelves is growing (we are talking about China), that is, in fact, the company carries out its warehouse on the shoulders of partners. It is possible, but the saturation of the channel does not solve the issue of the sale of these goods.

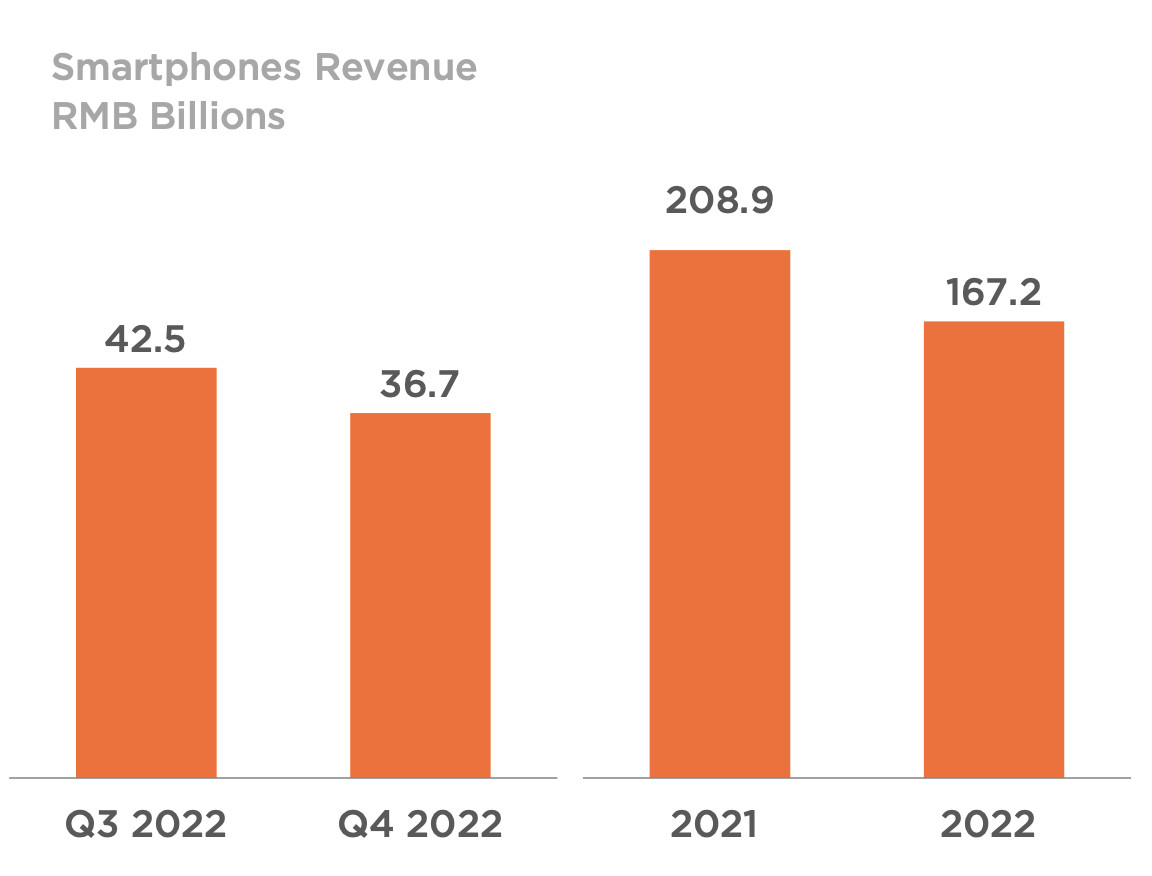

Let’s take a look at the margin that Xiaomi gets on smartphones.

The move to the premium segment began in mid-2020, and based on the results of 2021, we can see its impact. But then the fall, plus we recall that in a year the company lost 20% of sales in unit terms. Everything together suggests that Xiaomi is sacrificing market share for the sake of money, but everything is not so simple with money, the company does not receive them in the same amount as before.

Now let’s think about how much it costs to develop a smartphone with a shelf price of $300 and a device with a price of $1,000. The costs will not differ significantly, but the second device will cost you more. It will have a smaller circulation, as a result, you will have to purchase components (screens, processors, and so on) in smaller volumes, which will increase the cost. In absolute terms, the profit from one flagship is much higher than from the model of the middle segment. But in percentage terms, the economy is on the side of inexpensive models (the budget segment and the first price also do not correspond to this, the margin is minimal there). Leaving for the premium segment pushes all the prices of Xiaomi smartphones up, and this gives a negative result for sales of the entire line. Weak marketing and PR do not allow selling expensive models, devices used to sell themselves due to the price / quality ratio, but now other manufacturers, for example, realme, have taken the place of the company in this role.

No comments:

Post a Comment